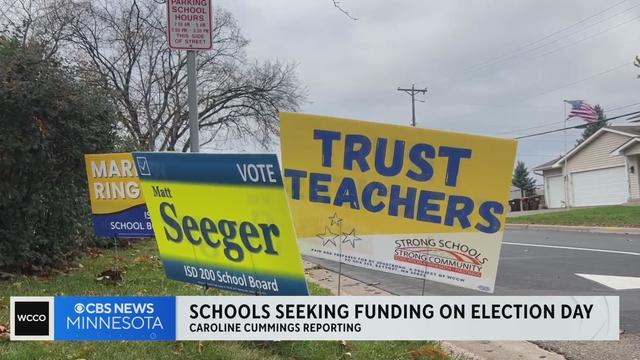

Dozens of school referendums on Minnesota ballots this election

When voters head to the polls Tuesday, some will see school referendums seeking additional funding for school renovations, technology, mental health support and more.

Watch CBS News

When voters head to the polls Tuesday, some will see school referendums seeking additional funding for school renovations, technology, mental health support and more.

Differences in local tax rates across the U.S. can add up for those who live in certain states.

The richest Americans often use trusts and other legal tax dodges to pass their wealth to their heirs tax-free, lawmakers say.

After a long legal fight, a House panel investigating the former president on Friday released new details of his tax returns.

Under new IRS rule, anyone who earned more than $600 this year by selling things online or doing gig work could face tax hit.

The hottest inflation in 40 years is likely to impact everything from your taxes to your retirement contributions.

Tax agency will forgo some late fees for people who were affected by health crisis, with average refund of $750.

Taxpayers have a few extra days this year to file; they're due Monday, April 18. The state's revenue department shared a few pointers Monday morning in anticipation of the kickoff for filing.

This year the IRS will start accepting tax returns in mid-February. But there are a few changes this year that you should know about.

Gov. Evers campaigned on paying for an income tax cut by reducing a corporate tax cut program by about $340 million.

Filing Minnesota state income tax returns for 2018 is going to be more of a pain than usual.

Ever wondered if you'll get a refund or owe Uncle Sam at tax time? The IRS wants us to stop guessing.

Tax Day 2016 is not on April 15 as usual. Instead, it has been moved to April 17 because of Washington D.C.'s Emancipation Day. Here is a look at why Tax Day is on April 15 to begin with, what Emancipation Day is, and when Tax Day can be moved to a later date.

A Minnesota Supreme Court ruling may be costly for some snowbirds. State residents who live part-time in another state could still get slapped with a hefty income tax bill.

The state Tax Department says the number of North Dakotans reporting income of more than $1 million went up 7.5 percent last year. The agency says 1,120 North Dakota taxpayers reported adjusted gross income of more than $1 million in 2014, compared with 1,041 North Dakotans in that category in 2013.

A new analysis of taxes in the U.S. finds Minnesota is one of the least tax friendly states.

Tax breaks can make raising children a little more affordable.

senate Republicans want to ditch Minnesota's tax on Social Security checks. Minnesota is one of just seven states that apply an income tax to Social Security. Seniors who make less than $25,000 a year are exempt.

Minnesota voters gave Gov. Dayton a solid re-election victory. But unlike the last two years of Democratic dominance, Dayton's fresh reality is a new Republican majority in the Minnesota House. "I'm proud to say that Democrats' total control of state government in Minnesota is over," said Rep. Kurt Daudt, the House minority leader. Exuberant Republicans will take back the House they lost just two years ago. That's when they battled Gov. Dayton to a budget standoff, and a 17-day government shutdown -- the longest in U.S. history.

The owner of a former Minneapolis restaurant was charged Wednesday with 68 counts of failing to pay sales tax and filing fraudulent and false tax returns. According to the Hennepin County Attorney's Office, 46-year-old Michael Ralph Whitelaw underreported sales by more than $1 million, and he underpaid tax by $100,000.

If you haven't filed your 2013 income taxes yet, the clock is ticking. You have until the end of the day to get them done, get them in the mail or file for an extension. Officials with the Internal Revenue Service said about 35 million tax payers wait until the last week to file their taxes.

Democratic Gov. Mark Dayton's goal of enacting a bill cutting and repealing taxes by next Friday appears unlikely to be met. Assistant Majority Leader Katie Sieben said Friday it will be "difficult" for that chamber to pass a plan by then. The House voted 126-2 on Thursday for $500 million in tax reductions on businesses and for state income tax filers.

A narrow band of Minnesotans will pay a higher income tax under the new state budget. How much more? That depends. Officials say the average cost of the new tax for 54,400 filers is just shy of $7,200. But that figure can be misleading.

The Minnesota House plunged Wednesday into a debate over a bill that would raise state taxes by $2.6 billion in part by enacting the state's first alcohol tax increase in about 25 years.

In the far corners of Gov. Mark Dayton's budget are lesser-heralded changes that would alter how Minnesota residents pay for and interact with their government from cradle to grave.

What do Lebron James, David Bowie and Bill Gates all have in common? They're left-handed. While they're a minority of the population, they're not alone. So why are we right- or left-handed? Good Question.

Kristin O'Neill scored twice, and Montreal rallied to beat Minnesota 4-3 on Thursday night in the Professional Women's Hockey League.

Tye Kartye tipped in a slap shot by Oliver Bjorkstrand for the tiebreaking goal with 2:40 remaining, and the Seattle Kraken beat the Minnesota Wild 4-3 to wrap up the regular season for two teams that missed the playoffs.

April showers bring May flowers, but they also bring mosquitoes.

The Minnesota House on Thursday approved legislation making changes to the state's new law legalizing cannabis for recreational use, including a pre-approval process for businesses to get a head start as regulators plan for market launch next year and contentious revisions to how those licenses will be issued.

April showers bring May flowers, but they also bring mosquitoes.

Minneapolis police are investigating a shooting that seriously injured a man Thursday afternoon on the city's northside.

It was a rescue almost right out of a movie. A handful of neighbors all fighting to save a group of baby eaglets.

School resource officers were notably absent from many Minnesota schools for most of this year, but in the last few weeks, several of them are back in the hallways.

Two parents face charges after they allegedly delayed medical attention for their 9-year-old daughter, who died after she had an asthma attack.

William Guy Amick III, 36, is facing 13 felony charges in Fillmore County that involve multiple victims between the ages of newborn and seven years old, according to the BCA.

A judge has dismissed two felony charges against a St. Olaf College student whom authorities accused of planning a "mass casualty event" after a cache was found in his dorm containing knives, empty ammunition boxes and more.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

Emergency medical services providers say they need a lifeline from the state legislature this session to the tune of $120 million to keep answering calls for help, especially in rural parts of Minnesota.

A southern Minnesota community is mourning, supporting a family after their 1-year-old son fell to his death from a hotel window.

Republican lawmakers have filed a new lawsuit alleging partial vetoes Gov. Tony Evers made to a bill designed to bolster students' reading performance were unconstitutional.

Nicolae Miu, the man convicted of reckless homicide and other crimes after stabbing five people on Wisconsin's Apple River in 2022, will be sentenced this summer.

The director of Donald Trump's 2020 presidential campaign in Wisconsin who pushed allegations of widespread fraud that were ultimately debunked has been hired to run the Republican Party of Wisconsin heading into the November election.

Jurors have found Nicolae Miu guilty of multiple criminal charges, including homicide, in the 2022 Apple River stabbings in Wisconsin.

It's now up to the jury after eight days of testimony in the Apple River stabbing trial.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

More than a hundred kids battling various medical conditions got to take a mental break and just have fun on Sunday thanks to HopeKids Minnesota.

The iconic Stone Arch Bridge is closing so that some construction can be done. Folks were out enjoying it over the weekend before it closes on Monday, April 15th.

Shiloh Missionary Baptist Church is opening an outreach center.

The Minnesota House on Thursday approved legislation making changes to the state's new law legalizing cannabis for recreational use, including a pre-approval process for businesses to get a head start as regulators plan for market launch next year and contentious revisions to how those licenses will be issued.

Two U.S. officials confirm to CBS News that an Israeli missile has hit Iran, in apparent retaliation for last weekend's drone and missile attack on the Jewish state.

Amna Kiran immigrated to the U.S. from Pakistan in 2007. She noticed her students were having a problem with the state's written driver's test. So she wrote a bill, and now, it's becoming law.

Rep. Ilhan Omar's daughter says she was one of three students suspended from Barnard College following a pro-Palestinian protest at Columbia University on Thursday.

Republican lawmakers have filed a new lawsuit alleging partial vetoes Gov. Tony Evers made to a bill designed to bolster students' reading performance were unconstitutional.

There's a state recovery fund for families who are out of money for a loss due to a contractor, but there's a gap in the law — a contractor with one specialty is exempt from paying into the fund.

The Minnesota Department of Health says state inspectors have seized and destroyed about $500,000 worth of illegal cannabis products from retailers.

The Minneapolis City Council on Thursday voted to delay implementation of a controversial ordinance establishing a minimum wage for rideshare drivers in the city.

The Minneapolis City Council will be considering delaying the implementation of the rideshare ordinance by two months.

The Biden Administration is directing funding to help Minnesota get rid of forever chemicals in our water.

Minneapolis police are investigating a shooting that seriously injured a man Thursday afternoon on the city's northside.

William Guy Amick III, 36, is facing 13 felony charges in Fillmore County that involve multiple victims between the ages of newborn and seven years old, according to the BCA.

Two parents face charges after they allegedly delayed medical attention for their 9-year-old daughter, who died after she had an asthma attack.

A Bloomington man has been sentenced to nearly six months in jail for his role in the overdose death of a 15-year-old West St. Paul girl two years ago.

A judge has dismissed two felony charges against a St. Olaf College student whom authorities accused of planning a "mass casualty event" after a cache was found in his dorm containing knives, empty ammunition boxes and more.

Health officials are warning consumers not to consume the Infinite Herbs basil sold at Trader Joe's after 12 people were sickened.

Minnesota lawmakers are considering a bill to tweak the new paid family and medical leave program they passed last year.

Emergency medical services providers say they need a lifeline from the state legislature this session to the tune of $120 million to keep answering calls for help, especially in rural parts of Minnesota.

The $872 million most likely excludes any amount UnitedHealth may have paid to hackers in ransom.

The City of Hastings issued a notice on Wednesday morning informing its residents that some of its municipal wells are now above the allowable drinking standards for PFAS.

Taylor Swift's successes and failures, including the battle to regain control of her master recordings, are part of the syllabus at the University of California, Berkeley.

Taylor Swift took to social media hours ahead of the expected release of her new album "The Tortured Poets Department."

Guitar legend Dickey Betts, who co-founded the Allman Brothers Band and wrote their biggest hit, "Ramblin' Man," has died.

O.J. Simpson's longtime lawyer in Las Vegas says the end came quickly.

ABBA, Blondie and The Notorious B.I.G. are entering America's audio canon.

Kristin O'Neill scored twice, and Montreal rallied to beat Minnesota 4-3 on Thursday night in the Professional Women's Hockey League.

Tye Kartye tipped in a slap shot by Oliver Bjorkstrand for the tiebreaking goal with 2:40 remaining, and the Seattle Kraken beat the Minnesota Wild 4-3 to wrap up the regular season for two teams that missed the playoffs.

Fresh off of one of the best regular seasons in franchise history, the Minnesota Timberwolves are preparing for a playoff matchup with the Phoenix Suns.

Mya Hooten's infectious and exuberant reactions have become her signature. The moments after the Gophers senior nails a routine provide a season unlike any other.

Cedric Mullins hit a two-run homer in the bottom of the ninth inning to give the Baltimore Orioles a 4-2 victory over Minnesota and a three-game sweep of the Twins.

An emerging from the COVID-19 pandemic, more and more students are not going to school. In Talking Points, Esme Murphy talks to the people looking for solutions.

An emerging from the COVID-19 pandemic, more and more students are not going to school. Esme Murphy Republican Sen. Julia Coleman, the ranking Republican on the Senate education policy committee about the issue.

An emerging from the COVID-19 pandemic, more and more students are not going to school. Esme Murphy spoke Don Ryan, the program manager for Safe Communities, about their efforts to engage with truant students. At the capitol, Murphy spoke with Sen. Steve Cwodzinski about the legislative effort underway to address the issue.

An emerging from the COVID-19 pandemic, more and more students are not going to school. Esme Murphy spoke with John Choi, the Ramsey County Attorney, about his work on the frontlines of getting kids back into the classroom.

The clock is ticking for a possible end to rideshare services Uber and Lyft in the Twin Cities. Both companies have threatened to leave after the Minneapolis City Council passed a pay raise local drivers demanded. In Talking Points, Esme Murphy looks at last-minute efforts to find a compromise.

Decades ago, at an 88-acre pasture near Annandale, cars replaced cows and French Lake Auto Parts was born.

There's an attraction in Fergus Falls that's centered around a man-made disaster.

In this week's Finding Minnesota, John Lauritsen goes to New Ulm where the Minnesota Music Hall of Fame is celebrating 35 years.

It cost $85,000 to build St. Stan's — equivalent to about $100 million today. As the basilica approaches its 130th birthday, its biggest fans say they wouldn't change a thing.

Built in 1857, the stairs were originally wood. Around 1970, concrete replaced wood, but over time, that too crumbled.

What do Lebron James, David Bowie and Bill Gates all have in common? They're left-handed. While they're a minority of the population, they're not alone. So why are we right- or left-handed? Good Question.

April is Earth Month and we're less than a week from Earth Day. That timing matches up with an email we received from Mary in Minneapolis. She wants to know: What can the average person do to help reduce global warming? Good Question.

The gorgeous weekend we had was more than just a great time to get outside. For many, it was a chance to get their hands dirty whether they wanted to or not. We wanted to know How can we efficiently clean our homes? Good Question.

If you have a drawer packed with old cellphones, cameras and laptops, you're not alone. Global electronic waste has hit record highs and it's growing five times faster than recycling rates. So how should you dispose of e-waste?

It's a yearly expense that Minnesota drivers often aren't too fond of paying. Bill from Otsego wanted to know: How do they calculate license tab fees? Good Question.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

An early spring snowstorm made for many beautiful sights across the state of Minnesota over the weekend.

State fire officials say a grass fire near Waseca is contained Monday morning after burning more than 1,000 acres.

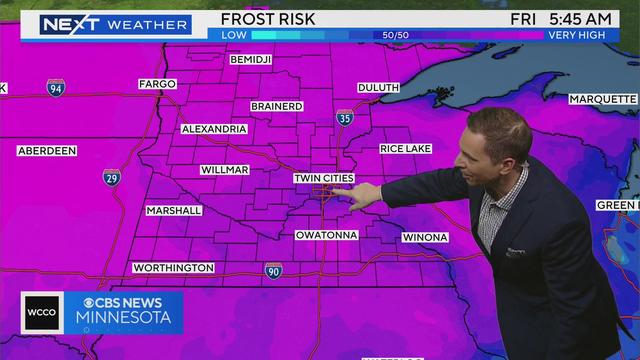

WCCO meteorologist Chris Shaffer says the next few nights are going to be cold ones.

In Minnesota, weather can be all over the place. Here at WCCO, we want to give you what you need to prepare for what's happening next.

WCCO meteorologist Chris Shaffer has your latest forecast, and he says that despite temperatures dropping off overnight there is something to look forward to in our upcoming forecast.

Temps are going to take a drop, and there’s a freeze warning for parts of southern Minnesota.

Thursday night is going to be a cold one — so cold, we're likely to see some frost.

WCCO meteorologist Chris Shaffer says the next few nights are going to be cold ones.

What do Lebron James, David Bowie and Bill Gates all have in common? They're left-handed. While they're a minority of the population, they're not alone. So why are we right- or left-handed? Good Question.

We have the latest tonight on the most recent rescue of cats found crowded inside Minnesota homes.

The daughter of a Minnesota congresswoman says protesting got her suspended from college.

The encampment, located at East 29th Street and Fifth Avenue South, drew outrage from residents and businesses in the area.