Here's how to file your taxes for free this year

Americans shell out billions of dollars to prepare and file their tax returns. Here's how to do it without spending a dime.

Watch CBS News

Americans shell out billions of dollars to prepare and file their tax returns. Here's how to do it without spending a dime.

Differences in local tax rates across the U.S. can add up for those who live in certain states.

Tax experts and the IRS itself have warned about smaller refund checks this year due to expiring pandemic aid.

Tax agency said it is trying to determine whether tax rebates, issued in many states last year, count as income.

The Democratic-controlled House Ways and Means Committee is expected to vote Tuesday on whether to publicly release years of the former president's tax returns.

Under new IRS rule, anyone who earned more than $600 this year by selling things online or doing gig work could face tax hit.

Tax agency will forgo some late fees for people who were affected by health crisis, with average refund of $750.

We're two months since the deadline for filing taxes and still millions of Americans are waiting on their money. Even people who filed six months ago.

The first round of advance Child Tax Credit payments went out to parents on July 15, but some payments have been delayed or were inaccurate.

Most American adults will get a payment.

According to the IRS, fewer taxpayers are getting refunds this year compared to the same time last year, and the average refund check is about $500 smaller.

Ever wondered if you'll get a refund or owe Uncle Sam at tax time? The IRS wants us to stop guessing.

To deter criminals, Senator Amy Klobuchar has introduced legislation to increase penalties for people who use stolen identities.

A Bloomington man was sentenced to 110 months in prison Wednesday afternoon for using hundreds of stolen identities to file false tax returns throughout the country.

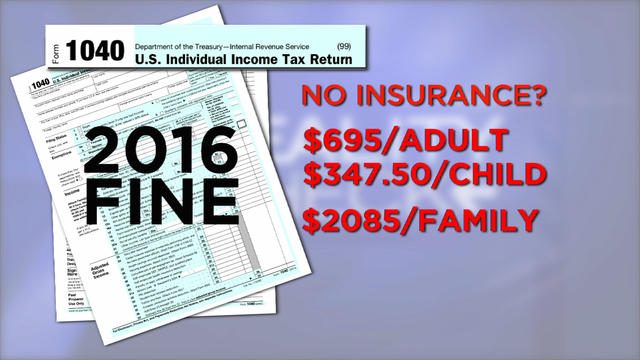

It's an important time of year for thousands of Minnesotans: Time to sign up for next year's health insurance. And if you don't get it, get ready to pay up anyway. The new federal health care law requires American citizens to have health insurance.

After easily securing a second term as Minnesota governor, Democrat Mark Dayton landed sizable checks toward his early-January inauguration, including some from corporations whose leaders favored the GOP nominee in the race.

Geared primarily towards low-to-middle income, working individuals and families, the Earned Income Tax Credit (EITC) is a federal benefit able to provide relief to those who meet specific criteria, by reducing the amount of tax owed and by increasing the amount of tax monies refunded, as determined after filing. Both single and married people can benefit from EITC, regardless of whether or not they have children or other dependents.

It's easy to make a mistake on your taxes, especially if you are a new business owner or running a small business. Before you file, dot your i's and cross your t's by making sure to use the correct tax forms.

The Minnesota Department of Revenue says taxpayers can start filing their Minnesota tax forms on Jan. 20. That's the same day that the IRS says taxpayers can start filing their 2014 returns.

Federal prosecutors say a Minnesota man has pleaded guilty to defrauding investors of more than $19 million. Fifty-five-year-old Tyrone Herman of St. Anthony entered his plea Friday in U.S. District Court. According to court documents, Herman claimed he could purchase small appliances from manufacturers and wholesalers at below-retail market rates.

Two inmates at a Minnesota prison are accused of filing $400,000 in false tax claims to the Internal Revenue Service, according to the U.S. Attorney's Office. Tony Terrell Robinson, 30, and Tanka James Tetzlaff, 39, were each charged Tuesday with one count of conspiracy to defraud the United States and 10 counts each of making false claims.

If you haven't filed your 2013 income taxes yet, the clock is ticking. You have until the end of the day to get them done, get them in the mail or file for an extension. Officials with the Internal Revenue Service said about 35 million tax payers wait until the last week to file their taxes.

If you haven't filed your 2013 income tax return yet, you have about a day to do so and get it in the mail or file paperwork for an extension to meet the April 15 deadline. But officials said the chances of getting audited are the lowest in years.

We are just a few days into tax filing season. Though most people probably haven't gotten their taxes done quite yet, WCCO took look into answering one of the most common questions. Tax season was delayed a few weeks, but the deadline is still April 15.

Minnesota Attorney General Lori Swanson is going after a company she says tricked hundreds of people into believing they were protecting their families. The lawsuit filed Monday claims Heritage Partners, LLC convinced aging Minnesotans that a licensed attorney would prepare a living trust of will to protect their assets. Customers claim they were actually sold lies. The government estimates 10,000 Baby Boomers retire each day, many of whom have already begun planning for their future.

A 25-year-old man has been sentenced to 40 years in prison for killing a teenager and injuring another in a drive-by shooting in Duluth last summer.

The change would create a minimum price of $15 for certain tobacco products, like cigarettes, ban coupons, stop samples that allow smoking inside and increase penalties for stores.

Issac Kamsin found himself knee-deep with repairs after buying a home. He was quoted thousands of dollars for a sewer problem, but he turned to a friend for help instead.

Strong storms across the central U.S. have caused damage and spawned tornadoes, with more severe storms in the forecast through the night.

The state's largest police organization is doubling down on calls to have the case against trooper Ryan Londregan reassigned.

The change would create a minimum price of $15 for certain tobacco products, like cigarettes, ban coupons, stop samples that allow smoking inside and increase penalties for stores.

Issac Kamsin found himself knee-deep with repairs after buying a home. He was quoted thousands of dollars for a sewer problem, but he turned to a friend for help instead.

The state's largest police organization is doubling down on calls to have the case against trooper Ryan Londregan reassigned.

A key lawmaker backing legislation mandating new regulations for rideshare operations in Minnesota said Tuesday that stakeholders are "very close" to an agreement on wages for drivers — a sticking point in negotiations.

Mills Church and Habitat for Humanity have submitted a new proposal for more affordable housing units on the church's property.

A 25-year-old man has been sentenced to 40 years in prison for killing a teenager and injuring another in a drive-by shooting in Duluth last summer.

Police say a 32-year-old St. Cloud man is expected to face several criminal charges following a domestic assault-related standoff early Saturday.

This spring, trillions of periodical cicadas are primed to emerge from the ground in parts of the United States, bringing their inundatory buzzing and strewing remnant husks here and there.

A central Minnesota man has been sentenced to more than 13 years in prison for killing an elderly Twin Cities woman while fleeing from police in a stolen vehicle.

Nineteen Minnesota cities and towns have levels of PFAS that exceed new federal guidelines for drinking water, and three of those communities are seeking support from the legislature this year to assist with their clean-up efforts.

The director of Donald Trump's 2020 presidential campaign in Wisconsin who pushed allegations of widespread fraud that were ultimately debunked has been hired to run the Republican Party of Wisconsin heading into the November election.

Jurors have found Nicolae Miu guilty of multiple criminal charges, including homicide, in the 2022 Apple River stabbings in Wisconsin.

It's now up to the jury after eight days of testimony in the Apple River stabbing trial.

Attorneys had one last chance on Wednesday to convince a Wisconsin jury whether 54-year-old Nicolae Miu should go to prison for murder.

Nicolae Miu repeatedly said he feared for his life on the day that he stabbed five people — killing one — on the Apple River, according to his police interview that was shown as part of his trial on Tuesday morning.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

More than a hundred kids battling various medical conditions got to take a mental break and just have fun on Sunday thanks to HopeKids Minnesota.

The iconic Stone Arch Bridge is closing so that some construction can be done. Folks were out enjoying it over the weekend before it closes on Monday, April 15th.

Shiloh Missionary Baptist Church is opening an outreach center.

One person was killed and homes, business, churches and schools were badly damaged or destroyed.

The change would create a minimum price of $15 for certain tobacco products, like cigarettes, ban coupons, stop samples that allow smoking inside and increase penalties for stores.

A key lawmaker backing legislation mandating new regulations for rideshare operations in Minnesota said Tuesday that stakeholders are "very close" to an agreement on wages for drivers — a sticking point in negotiations.

The two-month delay in implementing Minneapolis' rideshare ordinance buys leaders at the Minnesota Capitol more time to find a statewide solution.

Despite the laws passed last session, they say their work is just getting started.

Hundreds of gun safety advocates were at the Minnesota Capitol on Tuesday for an annual rally in support of tighter gun laws.

There's a state recovery fund for families who are out of money for a loss due to a contractor, but there's a gap in the law — a contractor with one specialty is exempt from paying into the fund.

The Minnesota Department of Health says state inspectors have seized and destroyed about $500,000 worth of illegal cannabis products from retailers.

The Minneapolis City Council on Thursday voted to delay implementation of a controversial ordinance establishing a minimum wage for rideshare drivers in the city.

The Minneapolis City Council will be considering delaying the implementation of the rideshare ordinance by two months.

The Biden Administration is directing funding to help Minnesota get rid of forever chemicals in our water.

A 25-year-old man has been sentenced to 40 years in prison for killing a teenager and injuring another in a drive-by shooting in Duluth last summer.

The state's largest police organization is doubling down on calls to have the case against trooper Ryan Londregan reassigned.

The Minnesota Bureau of Criminal Apprehension identified the four deputies who fired their guns when executing a warrant turned deadly last week in Minnetonka.

Police say a 32-year-old St. Cloud man is expected to face several criminal charges following a domestic assault-related standoff early Saturday.

The Hennepin County Medical Examiner's Office said 46-year-old Aidarus Sharif-Mohamed Ali died of a gunshot wound to the head on Feb. 16. His manner of death was homicide, the examiner said.

The $872 million most likely excludes any amount UnitedHealth may have paid to hackers in ransom.

The City of Hastings issued a notice on Wednesday morning informing its residents that some of its municipal wells are now above the allowable drinking standards for PFAS.

The prepackaged boxes of deli meat, cheese and crackers are not a healthy choice for kids, advocacy group says.

Mistreatment while giving birth is a "regular occurrence," researchers from the Columbia University Mailman School of Public Health said.

In Talking Points, there's new hope for dementia patients and their loved ones. Esme Murphy dives into the new medications and research that are bringing hope to patients in the early stages of dementia.

ABBA, Blondie and The Notorious B.I.G. are entering America's audio canon.

The Minnesota State Fair will be bringing in Ludacris and T-Pain for this summer's Grandstand Concert Series.

In the 1,000th episode, titled "A Thousand Yards," NCIS comes under attack by a mysterious enemy from the past.

A Billy Joel special on CBS and Paramount+ will air again after it was cut off in the middle of the singer's performance of "Piano Man."

It's a popular summer staple, but it's also quite competitive. Ramsey County hosts eight weeks of summer Day Camp at the Tamarack Nature Center — when registration opened up at the start of February, spots filled up within 10 minutes.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

Despite losing stars and leaders like Danielle Hunter and Jordan Hicks, the remaining defensive core got a boost this offseason when future hall of famer Harrison Smith announced he would return.

If you want to catch Caitlin Clark's first pro game against the Minnesota Lynx this summer, be prepared to shell out some major cash.

Here's everything you need to know about Alissa Pili, the newest member of the Minnesota Lynx's lineup.

Kirill Kaprizov had a goal and an assist, and the Minnesota Wild beat Los Angeles 3-1 on Monday night, ending the Kings' eight-game home winning streak.

An emerging from the COVID-19 pandemic, more and more students are not going to school. In Talking Points, Esme Murphy talks to the people looking for solutions.

An emerging from the COVID-19 pandemic, more and more students are not going to school. Esme Murphy Republican Sen. Julia Coleman, the ranking Republican on the Senate education policy committee about the issue.

An emerging from the COVID-19 pandemic, more and more students are not going to school. Esme Murphy spoke Don Ryan, the program manager for Safe Communities, about their efforts to engage with truant students. At the capitol, Murphy spoke with Sen. Steve Cwodzinski about the legislative effort underway to address the issue.

An emerging from the COVID-19 pandemic, more and more students are not going to school. Esme Murphy spoke with John Choi, the Ramsey County Attorney, about his work on the frontlines of getting kids back into the classroom.

The clock is ticking for a possible end to rideshare services Uber and Lyft in the Twin Cities. Both companies have threatened to leave after the Minneapolis City Council passed a pay raise local drivers demanded. In Talking Points, Esme Murphy looks at last-minute efforts to find a compromise.

There's an attraction in Fergus Falls that's centered around a man-made disaster.

In this week's Finding Minnesota, John Lauritsen goes to New Ulm where the Minnesota Music Hall of Fame is celebrating 35 years.

It cost $85,000 to build St. Stan's — equivalent to about $100 million today. As the basilica approaches its 130th birthday, its biggest fans say they wouldn't change a thing.

Built in 1857, the stairs were originally wood. Around 1970, concrete replaced wood, but over time, that too crumbled.

You've heard of St. Patrick driving the snakes out of Ireland, but how about St. Urho driving the grasshoppers out of Finland?

The gorgeous weekend we had was more than just a great time to get outside. For many, it was a chance to get their hands dirty whether they wanted to or not. We wanted to know How can we efficiently clean our homes? Good Question.

If you have a drawer packed with old cellphones, cameras and laptops, you're not alone. Global electronic waste has hit record highs and it's growing five times faster than recycling rates. So how should you dispose of e-waste?

It's a yearly expense that Minnesota drivers often aren't too fond of paying. Bill from Otsego wanted to know: How do they calculate license tab fees? Good Question.

A long-standing community resource is evolving in ways you might not realize, now offering everything from e-books to streaming movies for free.

Lottery fever is spreading. After no big winner last night, the Powerball jackpot now tops $1.2 billion. Eight out of 10 of the largest lottery prizes have occurred just since 2021. So why are jackpots getting so big? Good Question.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

An early spring snowstorm made for many beautiful sights across the state of Minnesota over the weekend.

State fire officials say a grass fire near Waseca is contained Monday morning after burning more than 1,000 acres.

WCCO meteorologist Chris Shaffer says rain will stick around until lunchtime tomorrow.

In Minnesota, weather can be all over the place. Here at WCCO, we want to give you what you need to prepare for what's happening next.

Meteorologist Chris Shaffer says rain will keep falling in the metro through Wednesday afternoon.

Showers will continue into the evening and into Wednesday morning, though the strong winds should die down.

Meteorologist Lisa Meadows says much of Minnesota will see multiple rounds of rain, and potentially even thunderstorms, on Tuesday.

WCCO is celebrating 75 years with 75 moments that shaped Minnesota's history. Here's one many viewers will remember well. After 41 years at WCCO, Dave Moore anchored his final newscast on Dec. 5, 1991.

WCCO meteorologist Chris Shaffer says rain will stick around until lunchtime tomorrow.

A plan to increase the price of a pack of smokes has been put on hold. But as Ubah Ali reports, the debate in the Minneapolis City Council is still smoldering.

The new kiosk allows you to get your new tabs on the go without having to wait at the DMV.

Another new twist in the controversial case of a state trooper charged with murder. Two more trainers are saying that trooper didn't do anything wrong. As the family of Ricky Cobb II gets set to sue, the state's largest police organization is doubling down on calls to have the criminal case reassigned. Our Adam Duxter joins us with the latest.