Ilhan Omar's daughter says she was suspended from college after pro-Palestinian protest

Isra Hirsi says she was 1 of 3 students suspended from Barnard College following Thursday's protest.

Watch CBS News

Isra Hirsi says she was 1 of 3 students suspended from Barnard College following Thursday's protest.

Someone filmed the attack Thursday afternoon near the Wabasha Street Bridge downtown.

A person self-immolated at a park across from the courthouse where former President Donald Trump's New York criminal trial is taking place.

First lady Jill Biden is set to visit the Twin Cities on Friday to attend an education convention.

Israel launched at least one missile strike at Iran early Friday morning, U.S. officials confirmed to CBS News, in apparent retaliation for last weekend's drone and missile attack.

Thomas Lane, one of the former Minneapolis police officers convicted in the murder of George Floyd, has completed his federal prison sentence, but still remains in federal custody.

It was a rescue almost right out of a movie. A handful of neighbors all fighting to save a group of baby eaglets.

Two parents face charges after they allegedly delayed medical attention for their 9-year-old daughter, who died after she had an asthma attack.

Eight years after Prince died from an accidental fentanyl overdose, thousands of his fans are flocking to the Twin Cities.

Oak wilt, which has been in Minnesota for 70 years now, continues to spread. Arborists like James Ostlie say the risk is even greater this year.

If you're looking to plant annuals, Laura Mathews with Tangletown Gardens in Minneapolis says to be careful right now.

Department of Natural Resources Climatologist Pete Boulay says parts of the state are still 10 to 20 inches short of needed moisture.

Concerns grow about not having enough cannabis supply to meet legal market demand without a headstart on the cultivation of marijuana plants.

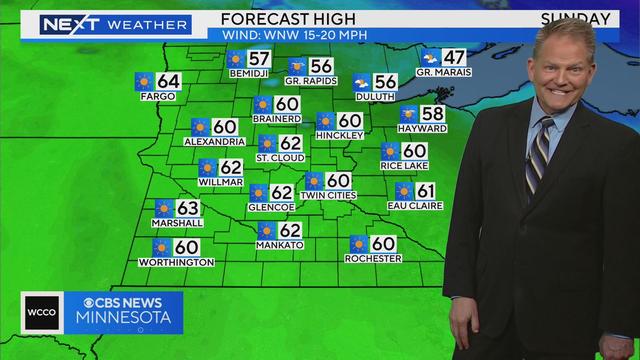

WCCO meteorologist Chris Shaffer has your latest forecast and he says don't fret about the chance for snow...as the weekend forecast will certainly brighten things up.

WCCO's Reg Chapman spoke with members of the late popstar's band about what this special show means to them, as well as their community.

A team of researchers want to make the world a better place and they believe the world's tropical forests are a good place to start.

WCCO's Jason Rantala follows up with local business owners in Uptown regarding the impact of construction on Hennepin Ave.

Outside of the Timberwolves' first playoff match, the Twins host the Tigers at 1:10 p.m. Saturday at Target Field, adding to a busy stretch for Minneapolis's North Loop neighborhood.

They're the only varsity team in Minnesota. There isn't a large water polo infrastructure in the state and no high school-affiliated programs.

The Wolverines had a record 18 players at the combine, giving them a chance to be the first school with at least 16 prospects picked in one NFL draft.

Kristin O'Neill scored twice, and Montreal rallied to beat Minnesota 4-3 on Thursday night in the Professional Women's Hockey League.

Tye Kartye tipped in a slap shot by Oliver Bjorkstrand for the tiebreaking goal with 2:40 remaining, and the Seattle Kraken beat the Minnesota Wild 4-3 to wrap up the regular season for two teams that missed the playoffs.

What do Lebron James, David Bowie and Bill Gates all have in common? They're left-handed. While they're a minority of the population, they're not alone. So why are we right- or left-handed? Good Question.

April is Earth Month and we're less than a week from Earth Day. That timing matches up with an email we received from Mary in Minneapolis. She wants to know: What can the average person do to help reduce global warming? Good Question.

The gorgeous weekend we had was more than just a great time to get outside. For many, it was a chance to get their hands dirty whether they wanted to or not. We wanted to know How can we efficiently clean our homes? Good Question.

If you have a drawer packed with old cellphones, cameras and laptops, you're not alone. Global electronic waste has hit record highs and it's growing five times faster than recycling rates. So how should you dispose of e-waste?

It's a yearly expense that Minnesota drivers often aren't too fond of paying. Bill from Otsego wanted to know: How do they calculate license tab fees? Good Question.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

More than a hundred kids battling various medical conditions got to take a mental break and just have fun on Sunday thanks to HopeKids Minnesota.

The iconic Stone Arch Bridge is closing so that some construction can be done. Folks were out enjoying it over the weekend before it closes on Monday, April 15th.

Shiloh Missionary Baptist Church is opening an outreach center.

One person was killed and homes, business, churches and schools were badly damaged or destroyed.

"It really does play major mind games," one inmate said. "I'm not able to call my wife. It does raise the stress level of everybody, and when that happens...it can really push people over the edge."

A church in North Minneapolis says they've been burglarized five times since the first of the year.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

Eight years after Prince died from an accidental fentanyl overdose, thousands of his fans are flocking to the Twin Cities.

Saturday marks, for some, a holiday.

A Minnesota family-run business for 60 years, said hackers changed the phone number on their Google listing in order to scam potential customers.

Outside of the Timberwolves' first playoff match, the Twins host the Tigers at 1:10 p.m. Saturday at Target Field, adding to a busy stretch for Minneapolis's North Loop neighborhood.

Dante Joseph Tyus, 30, of Brooklyn Center, was found guilty of possessing a firearm as a felon by a federal jury on Friday.

A 70-year-old Mankato man is recovering after he was struck by an SUV Thursday night.

The 59th annual Flood Run motorcycle ride is this Saturday, and the Minnesota State Patrol is asking bikers and motorists alike to be extra careful while cruising beside the St. Croix River.

William Guy Amick III, 36, is facing 13 felony charges in Fillmore County that involve multiple victims between the ages of newborn and seven years old, according to the BCA.

A judge has dismissed two felony charges against a St. Olaf College student whom authorities accused of planning a "mass casualty event" after a cache was found in his dorm containing knives, empty ammunition boxes and more.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

The 59th annual Flood Run motorcycle ride is this Saturday, and the Minnesota State Patrol is asking bikers and motorists alike to be extra careful while cruising beside the St. Croix River.

A partial building collapse in Superior, Wisconsin prompted evacuations Thursday, including at a nearby daycare.

Republican lawmakers have filed a new lawsuit alleging partial vetoes Gov. Tony Evers made to a bill designed to bolster students' reading performance were unconstitutional.

Nicolae Miu, the man convicted of reckless homicide and other crimes after stabbing five people on Wisconsin's Apple River in 2022, will be sentenced this summer.

The director of Donald Trump's 2020 presidential campaign in Wisconsin who pushed allegations of widespread fraud that were ultimately debunked has been hired to run the Republican Party of Wisconsin heading into the November election.

Concerns grow about not having enough cannabis supply to meet legal market demand without a headstart on the cultivation of plants.

A person self-immolated at a park across from the courthouse where former President Donald Trump's New York criminal trial is taking place.

Democrats may have to offer Johnson a lifeline if it comes to a vote, given Republicans' razor-thin majority.

The jury selection process in former President Donald Trump's New York trial came to a close on Friday, part of a flurry of activity that marked the end of a dizzying first week.

The Minnesota House on Thursday approved legislation making changes to the state's new law legalizing cannabis for recreational use.

Saturday marks, for some, a holiday.

There's a state recovery fund for families who are out of money for a loss due to a contractor, but there's a gap in the law — a contractor with one specialty is exempt from paying into the fund.

The Minnesota Department of Health says state inspectors have seized and destroyed about $500,000 worth of illegal cannabis products from retailers.

The Minneapolis City Council on Thursday voted to delay implementation of a controversial ordinance establishing a minimum wage for rideshare drivers in the city.

The Minneapolis City Council will be considering delaying the implementation of the rideshare ordinance by two months.

A Minnesota family-run business for 60 years, said hackers changed the phone number on their Google listing in order to scam potential customers.

The man who officers were looking for when they were met with gunfire at a Minnetonka home last week is now in custody.

Dante Joseph Tyus, 30, of Brooklyn Center, was found guilty of possessing a firearm as a felon by a federal jury on Friday.

St. Paul police are investigating what they call a "shocking and unusual incident" after someone filmed an apparent whip attack Thursday afternoon near the Wabasha Street Bridge downtown.

The jury selection process in former President Donald Trump's New York trial came to a close on Friday, part of a flurry of activity that marked the end of a dizzying first week.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Minnesota lawmakers are considering a bill to tweak the new paid family and medical leave program they passed last year.

Emergency medical services providers say they need a lifeline from the state legislature this session to the tune of $120 million to keep answering calls for help, especially in rural parts of Minnesota.

The $872 million most likely excludes any amount UnitedHealth may have paid to hackers in ransom.

The City of Hastings issued a notice on Wednesday morning informing its residents that some of its municipal wells are now above the allowable drinking standards for PFAS.

Eight years after Prince died from an accidental fentanyl overdose, thousands of his fans are flocking to the Twin Cities.

The singer was found deceased at her home, a representative said.

Taylor Swift's successes and failures, including the battle to regain control of her master recordings, are part of the syllabus at the University of California, Berkeley.

Anticipation was growing at a fever pitch before Taylor Swift's latest album, "The Tortured Poets Department," dropped at midnight EDT. But it turned out it's actually a double album.

Guitar legend Dickey Betts, who co-founded the Allman Brothers Band and wrote their biggest hit, "Ramblin' Man," has died.