MN Sen. Nicole Mitchell, charged with burglary, says she was checking on loved one with Alzheimer's

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Watch CBS News

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Several protesters were arrested on Tuesday morning at the University of Minnesota, where they had set up a pro-Palestinian encampment to demand the university divest from companies and academic institutions they say support Israel.

August Golden, 35, was killed and six others were hurt in the shooting on the evening of Aug. 11, 2023.

Senators approve foreign aid package that includes a potential ban on TikTok in the U.S. Here's what experts say could happen next.

Jaden McDaniels scored 25 points for a career best in the playoffs and spearheaded another stifling defensive performance by the Minnesota Timberwolves in a 105-93 victory over the Phoenix Suns to take a 2-0 lead in their first-round series.

Several venues across Minnesota want to help, posting on Facebook that they're ready to either donate their space or negotiate lower prices.

A drone pilot made a mysterious discovery last week while flying over a Twin Cities pond.

Even though it's considered a lifetime ban, it isn't for everyone. In Dakota County, since 2019, 109 people there tried to have their gun rights restored. Of those, 72 succeeded.

The Hennepin County Sheriff's Office on Wednesday released body camera footage of a shootout in Minnetonka that left a man dead and two deputies injured.

Scientists say Minnesota's Northwoods are at risk of becoming grasslands in as little as 50 years because trees can't adapt as quickly as our weather is warming.

Researchers say if help doesn't arrive soon, the deep, dark boreal forests we know in northern Minnesota could become mostly grasslands within the next 50 years.

Oak wilt, which has been in Minnesota for 70 years now, continues to spread. Arborists like James Ostlie say the risk is even greater this year.

WCCO meteorologist Chris Shaffer says the wind picks up again tomorrow, and we warm to near 70.

It’s one of the few covered bridges remaining in the Midwest, and it’s seen a lot of traffic over the years. In this week’s Finding Minnesota, John Lauritsen shows us why Zumbrota residents and visitors celebrate this man-made work of art.

Maple Grove is making a big statement, calling itself the "restaurant capital" of Minnesota. It's a bold claim. We took a closer look at whether they can back it up.

The Minnesotan behind the design talked to WCCO about it for the first time.

A deputy was inside their squad car on the side of the road when a black SUV slammed into it from behind.

Willi Castro hit a 3-run home run on his 27th birthday and Joe Ryan pitched six innings for his first win of the year as the Minnesota Twins beat the Chicago White Sox 6-3 Wednesday.

Naz Reid, who helped the Minnesota Timberwolves overcome an injury to Karl-Anthony Towns to have one of the best seasons in franchise history, was voted the NBA's Sixth Man of the Year.

Steve Little has been collecting Timberwolves memorabilia inside his St. Cloud home for 18 years as a season ticket holder.

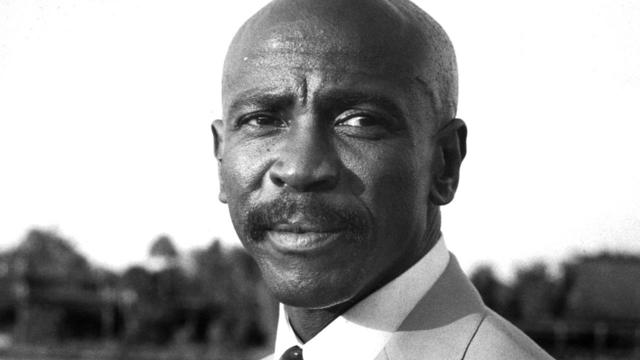

Allen Shaver, the play-by-play announcer of the Minnesota North Stars for over 20 years, has died at 96 years old.

Alex Kirilloff hit a two-out, game-ending single after Byron Buxton led off the ninth inning with a tying homer, and the major league-worst Chicago White Sox fell to 3-20 with a 6-5 loss to the Minnesota Twins.

It's one of the few covered bridges remaining in the Midwest, and it's seen a lot of traffic over the years.

Decades ago, at an 88-acre pasture near Annandale, cars replaced cows and French Lake Auto Parts was born.

There's an attraction in Fergus Falls that's centered around a man-made disaster.

In this week's Finding Minnesota, John Lauritsen goes to New Ulm where the Minnesota Music Hall of Fame is celebrating 35 years.

It cost $85,000 to build St. Stan's — equivalent to about $100 million today. As the basilica approaches its 130th birthday, its biggest fans say they wouldn't change a thing.

The nation's third-largest food bank is using a 24-hour fundraiser to fight food insecurity.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Fifteen-year-old Bennett Fisk loves baseball and has been playing youth league his whole life. Unfortunately, last season, he had to sit out because even the largest adult-size baseball helmet didn't fit his head and it was too unsafe to play without a helmet.

For the first time in Minnesota cannabis usage on 420 is legal.

A new restaurant is hoping to serve the community for years to come.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

More than a hundred kids battling various medical conditions got to take a mental break and just have fun on Sunday thanks to HopeKids Minnesota.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

The Hennepin County Sheriff's Office on Wednesday released body camera footage of a shootout in Minnetonka that left a man dead and two deputies injured.

A trooper was at the scene of a crash on eastbound Highway 36 at Snelling Avenue around 6 p.m. when they noticed a vehicle driving erratically coming up behind them.

Maple Grove is giving people who plan on strolling down its Main Street something new to chew on — the suburban city boldly dubbed itself Minnesota's culinary capital last week.

Political analyst David Schultz says these students could swing the presidential election.

Officials for Spring Lake Park High School say it received a phone call of a bomb threat shortly after 12 p.m.

It's one of the few covered bridges remaining in the Midwest, and it's seen a lot of traffic over the years.

The Metropolitan Council has made headlines for its mismanagement of the Southwest Light Rail project. In Talking Points, community members and Minnesota legislators on both sides of the aisle are pushing for major reforms.

A community tour Wednesday highlighted a massive investment to one of Minnesota's 15 fish hatcheries – a $20 million makeover, nearly 70 years in the making.

Two people are dead after a head-on crash Tuesday evening in southern Minnesota.

A Korean War veteran from Minnesota who still carries shrapnel in his leg from when he was wounded in combat will finally get his Purple Heart medal, 73 years late.

The 59th annual Flood Run motorcycle ride is this Saturday, and the Minnesota State Patrol is asking bikers and motorists alike to be extra careful while cruising beside the St. Croix River.

A partial building collapse in Superior, Wisconsin prompted evacuations Thursday, including at a nearby daycare.

Republican lawmakers have filed a new lawsuit alleging partial vetoes Gov. Tony Evers made to a bill designed to bolster students' reading performance were unconstitutional.

Nicolae Miu, the man convicted of reckless homicide and other crimes after stabbing five people on Wisconsin's Apple River in 2022, will be sentenced this summer.

The director of Donald Trump's 2020 presidential campaign in Wisconsin who pushed allegations of widespread fraud that were ultimately debunked has been hired to run the Republican Party of Wisconsin heading into the November election.

Political analyst David Schultz says these students could swing the presidential election.

The Metropolitan Council has made headlines for its mismanagement of the Southwest Light Rail project. In Talking Points, community members and Minnesota legislators on both sides of the aisle are pushing for major reforms.

Minnesota Senate Republicans on Wednesday filed an ethics complaint against DFL Sen. Nicole Mitchell, who was charged Tuesday with first-degree burglary in connection to a home break-in.

The Metropolitan Council has made headlines for its mismanagement of the Southwest Light Rail project. In Talking Points, Esme Murphy spoke with DFL Sen. Scott Dibble and Republican Sen. Eric Pratt about the legislation push major reforms.

The Metropolitan Council has made headlines for its mismanagement of the Southwest Light Rail project. In Talking Points, community members and Minnesota legislators on both sides of the aisle are pushing for major reforms. Esme Murphy spoke with Abou Amara, a Democratic analyst, and Mary Pattock, a long-time critic of the Met Council.

The owner of a Twin Cities-based car dealership is accused of scamming Minnesotans out of thousands of dollars.

Saturday marks, for some, a holiday.

There's a state recovery fund for families who are out of money for a loss due to a contractor, but there's a gap in the law — a contractor with one specialty is exempt from paying into the fund.

The Minnesota Department of Health says state inspectors have seized and destroyed about $500,000 worth of illegal cannabis products from retailers.

The Minneapolis City Council on Thursday voted to delay implementation of a controversial ordinance establishing a minimum wage for rideshare drivers in the city.

The Hennepin County Sheriff's Office on Wednesday released body camera footage of a shootout in Minnetonka that left a man dead and two deputies injured.

The DEA took about 2.5 million lethal doses of fentanyl off Minnesota streets last year alone. Despite that eye-popping number, it's not enough.

Minnesota Senate Republicans on Wednesday filed an ethics complaint against DFL Sen. Nicole Mitchell, who was charged Tuesday with first-degree burglary in connection to a home break-in.

The goal is to give kids access to mentors and resources before they get involved in the criminal justice system.

A jury found a 28-year-old Hastings woman guilty in connection to a drive-by shooting in St. Paul that critically injured a 10-year-old boy on New Year's Eve.

The DEA took about 2.5 million lethal doses of fentanyl off Minnesota streets last year alone. Despite that eye-popping number, it's not enough.

Federal officials say they're double checking whether pasteurization has eradicated the danger from possible bird virus particles in milk.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Cancer cases are on the rise in younger adults, and early onset cancer is up in patients under 50, many of them without typical risk factors.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

The Vali-Hi Drive-In in Lake Elmo has been closed for almost two years now — but a filmmaker raised in Woodbury is keeping memories of the iconic theatre alive.

Eight years ago this week, music icon Prince died of an accidental painkiller overdose at his Paisley Park estate.

La Raza's mission is to bring music, news and community to more than 200,000 Latinos in the Twin Cities.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

Eight years after Prince died from an accidental fentanyl overdose, thousands of his fans are flocking to the Twin Cities.