Charges: State Senator burgled stepmother's home to get father's ashes, sentimental items

Nicole Mitchell, DFL-Woodbury, now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Watch CBS News

Nicole Mitchell, DFL-Woodbury, now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Some soon-to-be-newlyweds are in shock and out of thousands of dollars after a wedding venue abruptly closed down.

The 2024 NFL draft starts Thursday night, and fans — and even many other teams — are eagerly waiting to see what the Minnesota Vikings will do.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Video shows a heroic group effort to save the life of a driver stuck in a burning vehicle in St. Paul last week.

Around 7:30 p.m., residents of Hennepin County received a message instructing them to shelter in place due to police activity in Robbinsdale.

It happened Monday morning in the parking lot of the Valley Creek Plaza shopping center, just east of Interstate 494.

Jesse Ventura's 1998 win for governor stands out as one of he most successful third-party runs in U.S. history.

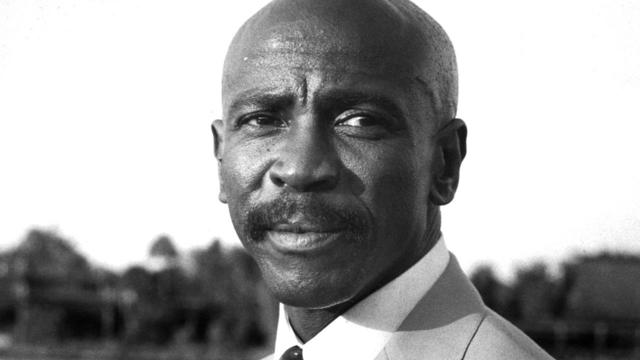

Sammy McDowell, who owns Sammy's Avenue Eatery, died after collapsing during church service, family members told WCCO.

Researchers say if help doesn't arrive soon, the deep, dark boreal forests we know in northern Minnesota could become mostly grasslands within the next 50 years.

Oak wilt, which has been in Minnesota for 70 years now, continues to spread. Arborists like James Ostlie say the risk is even greater this year.

If you're looking to plant annuals, Laura Mathews with Tangletown Gardens in Minneapolis says to be careful right now.

We're told to sit up straight, but is slouching and having bad posture really bad for you?

We're talkin' about which city is on Money Magazine's list of 50 Best Places to Live in the United States.

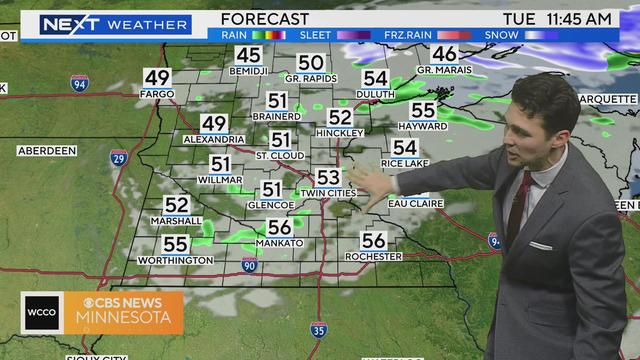

Meteorologist Joseph Dames has the latest forecast.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

We'll have a dry, sunny morning in the Twin Cities, but showers will arrive around midday.

The 2024 NFL draft starts Thursday night, and fans — and even many other teams — are eagerly waiting to see what the Minnesota Vikings will do.

Max Kepler had two hits and three RBIs in his return from the injured list and the Minnesota Twins beat the Chicago White Sox 7-0 Monday night.

The Minnesota Twins have sent struggling starting pitcher Louie Varland to Triple-A St. Paul and reinstated right fielder Max Kepler from the 10-day injured list.

After one of the best seasons in franchise history, two Minnesota Timberwolves players and head coach Chris Finch are finalists for major NBA awards.

Robin Lod had a goal and two assists and Minnesota United ended Charlotte FC's 13-match unbeaten run at home dating to last season with a 3-0 victory.

What do Lebron James, David Bowie and Bill Gates all have in common? They're left-handed. While they're a minority of the population, they're not alone. So why are we right- or left-handed? Good Question.

April is Earth Month and we're less than a week from Earth Day. That timing matches up with an email we received from Mary in Minneapolis. She wants to know: What can the average person do to help reduce global warming? Good Question.

The gorgeous weekend we had was more than just a great time to get outside. For many, it was a chance to get their hands dirty whether they wanted to or not. We wanted to know How can we efficiently clean our homes? Good Question.

If you have a drawer packed with old cellphones, cameras and laptops, you're not alone. Global electronic waste has hit record highs and it's growing five times faster than recycling rates. So how should you dispose of e-waste?

It's a yearly expense that Minnesota drivers often aren't too fond of paying. Bill from Otsego wanted to know: How do they calculate license tab fees? Good Question.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Fifteen-year-old Bennett Fisk loves baseball and has been playing youth league his whole life. Unfortunately, last season, he had to sit out because even the largest adult-size baseball helmet didn't fit his head and it was too unsafe to play without a helmet.

For the first time in Minnesota cannabis usage on 420 is legal.

A new restaurant is hoping to serve the community for years to come.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

More than a hundred kids battling various medical conditions got to take a mental break and just have fun on Sunday thanks to HopeKids Minnesota.

The iconic Stone Arch Bridge is closing so that some construction can be done. Folks were out enjoying it over the weekend before it closes on Monday, April 15th.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Dozens of students and parents rallied to support diversity programs, but some board members are threatening to block the budget of the state's largest district if it doesn't make some major changes.

A 15-year-old boy is fighting for his life and another is expected to recover after a shooting in north Minneapolis Monday afternoon.

Around 7:30 p.m., residents of Hennepin County received a message instructing them to shelter in place due to police activity in Robbinsdale.

Eight years ago this week, music icon Prince died of an accidental painkiller overdose at his Paisley Park estate.

Researchers say if help doesn't arrive soon, the deep, dark boreal forests we know in northern Minnesota could become mostly grasslands within the next 50 years.

A Minnesota state senator was arrested early Monday morning on suspicion of burglarizing a Detroit Lakes home, according to police.

Police in southern Minnesota arrested multiple people Saturday after finding thousands of pills containing fentanyl.

WCCO's Allen Henry breaks down rules and expectations now that weed is legal in the Land of 10,000 Lakes.

A 70-year-old Mankato man is recovering after he was struck by an SUV Thursday night.

The 59th annual Flood Run motorcycle ride is this Saturday, and the Minnesota State Patrol is asking bikers and motorists alike to be extra careful while cruising beside the St. Croix River.

A partial building collapse in Superior, Wisconsin prompted evacuations Thursday, including at a nearby daycare.

Republican lawmakers have filed a new lawsuit alleging partial vetoes Gov. Tony Evers made to a bill designed to bolster students' reading performance were unconstitutional.

Nicolae Miu, the man convicted of reckless homicide and other crimes after stabbing five people on Wisconsin's Apple River in 2022, will be sentenced this summer.

The director of Donald Trump's 2020 presidential campaign in Wisconsin who pushed allegations of widespread fraud that were ultimately debunked has been hired to run the Republican Party of Wisconsin heading into the November election.

No formal charges have been filed against Sen. Nicole Mitchell.

Follow live updates as former President Donald Trump's criminal trial resumes in New York.

Minnesota State Senator Nicole Mitchell was arrested early Monday morning on suspicion of burglarizing a Detroit Lakes home, according to police. Mitchell has not yet been formally charged.

Protesters have been arrested at Columbia and Yale as they've refused to move, calling for a break from Israel.

A bill that could ultimately ban TikTok in the U.S. will soon head for a vote in the Senate. Here's what experts say to expect next.

Saturday marks, for some, a holiday.

There's a state recovery fund for families who are out of money for a loss due to a contractor, but there's a gap in the law — a contractor with one specialty is exempt from paying into the fund.

The Minnesota Department of Health says state inspectors have seized and destroyed about $500,000 worth of illegal cannabis products from retailers.

The Minneapolis City Council on Thursday voted to delay implementation of a controversial ordinance establishing a minimum wage for rideshare drivers in the city.

The Minneapolis City Council will be considering delaying the implementation of the rideshare ordinance by two months.

A Minnesota man is accused of sexually exploiting children abroad.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

The trial of the first seven defendants in what federal prosecutors call the largest pandemic-era fraud case in the country is underway.

A 15-year-old boy is fighting for his life and another is expected to recover after a shooting in north Minneapolis Monday afternoon.

Around 7:30 p.m., residents of Hennepin County received a message instructing them to shelter in place due to police activity in Robbinsdale.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Cancer cases are on the rise in younger adults, and early onset cancer is up in patients under 50, many of them without typical risk factors.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Minnesota lawmakers are considering a bill to tweak the new paid family and medical leave program they passed last year.

Eight years ago this week, music icon Prince died of an accidental painkiller overdose at his Paisley Park estate.

La Raza's mission is to bring music, news and community to more than 200,000 Latinos in the Twin Cities.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

Eight years after Prince died from an accidental fentanyl overdose, thousands of his fans are flocking to the Twin Cities.

Taylor Swift broke her own records, Spotify said, and now owns the record for the top three most-streamed albums in a single day.