MN Sen. Nicole Mitchell, charged with burglary, says she was checking on loved one with Alzheimer's

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Watch CBS News

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

Several protesters were arrested on Tuesday morning at the University of Minnesota, where they had set up a pro-Palestinian encampment to demand the university divest from companies and academic institutions they say support Israel.

Jaden McDaniels scored 25 points for a career best in the playoffs and spearheaded another stifling defensive performance by the Minnesota Timberwolves in a 105-93 victory over the Phoenix Suns to take a 2-0 lead in their first-round series.

Several venues across Minnesota want to help, posting on Facebook that they're ready to either donate their space or negotiate lower prices.

August Golden, 35, was killed and six others were hurt in the shooting on the evening of Aug. 11, 2023.

A drone pilot made a mysterious discovery last week while flying over a Twin Cities pond.

Even though it's considered a lifetime ban, it isn't for everyone. In Dakota County, since 2019, 109 people there tried to have their gun rights restored. Of those, 72 succeeded.

A frost advisory is in place in the Twin Cities until 8 a.m. Wednesday.

It comes over a year after a shooting at a Nashville school killed three children and three adults.

Researchers say if help doesn't arrive soon, the deep, dark boreal forests we know in northern Minnesota could become mostly grasslands within the next 50 years.

Oak wilt, which has been in Minnesota for 70 years now, continues to spread. Arborists like James Ostlie say the risk is even greater this year.

If you're looking to plant annuals, Laura Mathews with Tangletown Gardens in Minneapolis says to be careful right now.

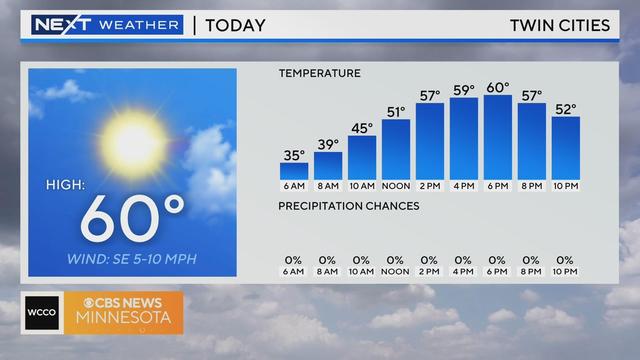

Meteorologist Joseph Dames says after a chilly morning, Wednesday will be sunny and less windy.

The Brooklyn Park Community Activity Center is hosting a delicious event this week from Wednesday through Friday.

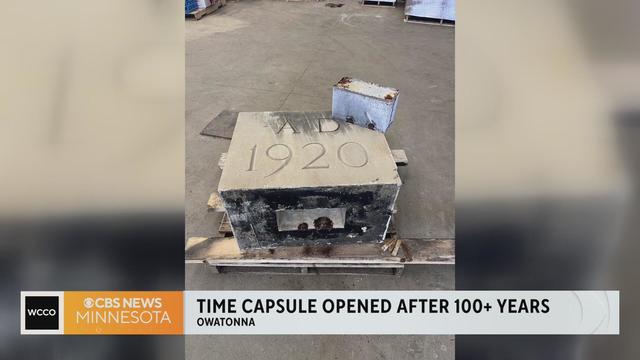

A high school time capsule in southern Minnesota has been opened after 124 years.

The bustling intersection of West 43rd Street and Upton Avenue South in Minneapolis’ Linden Hills neighborhood will be shut down for more than two months as crews work to replace a water main and sewer line.

Eight students and one faculty member were arrested on Tuesday during anti-war protests at the Univeristy of Minnesota in Minneapolis.

Alex Kirilloff hit a two-out, game-ending single after Byron Buxton led off the ninth inning with a tying homer, and the major league-worst Chicago White Sox fell to 3-20 with a 6-5 loss to the Minnesota Twins.

Jaden McDaniels scored 25 points for a career best in the playoffs and spearheaded another stifling defensive performance by the Minnesota Timberwolves in a 105-93 victory over the Phoenix Suns to take a 2-0 lead in their first-round series.

The Minnesota Timberwolves ownership dispute is moving into mediation.

Tyler Nubin says he's approaching 100% health and performing well at the Gophers pro day in front of NFL scouts, as well as many of the Minnesota Vikings coaches.

The 2024 NFL draft starts Thursday night, and fans — and even many other teams — are eagerly waiting to see what the Minnesota Vikings will do.

What do Lebron James, David Bowie and Bill Gates all have in common? They're left-handed. While they're a minority of the population, they're not alone. So why are we right- or left-handed? Good Question.

April is Earth Month and we're less than a week from Earth Day. That timing matches up with an email we received from Mary in Minneapolis. She wants to know: What can the average person do to help reduce global warming? Good Question.

The gorgeous weekend we had was more than just a great time to get outside. For many, it was a chance to get their hands dirty whether they wanted to or not. We wanted to know How can we efficiently clean our homes? Good Question.

If you have a drawer packed with old cellphones, cameras and laptops, you're not alone. Global electronic waste has hit record highs and it's growing five times faster than recycling rates. So how should you dispose of e-waste?

It's a yearly expense that Minnesota drivers often aren't too fond of paying. Bill from Otsego wanted to know: How do they calculate license tab fees? Good Question.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Fifteen-year-old Bennett Fisk loves baseball and has been playing youth league his whole life. Unfortunately, last season, he had to sit out because even the largest adult-size baseball helmet didn't fit his head and it was too unsafe to play without a helmet.

For the first time in Minnesota cannabis usage on 420 is legal.

A new restaurant is hoping to serve the community for years to come.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

More than a hundred kids battling various medical conditions got to take a mental break and just have fun on Sunday thanks to HopeKids Minnesota.

The iconic Stone Arch Bridge is closing so that some construction can be done. Folks were out enjoying it over the weekend before it closes on Monday, April 15th.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

Even though it's considered a lifetime ban, it isn't for everyone. In Dakota County, since 2019, 109 people there tried to have their gun rights restored. Of those, 72 succeeded.

Anoka County is one of the few counties that could decide who wins Minnesota in the 2024 presidential election.

Tyler Nubin says he's approaching 100% health and performing well at the Gophers pro day in front of NFL scouts, as well as many of the Minnesota Vikings coaches.

Several venues across Minnesota want to help, posting on Facebook that they're ready to either donate their space or negotiate lower prices.

The Vali-Hi Drive-In in Lake Elmo has been closed for almost two years now — but a filmmaker raised in Woodbury is keeping memories of the iconic theatre alive.

A Korean War veteran from Minnesota who still carries shrapnel in his leg from when he was wounded in combat will finally get his Purple Heart medal, 73 years late.

The Brown County Sheriff's Office says fire crews responded to 16 wildfires between March 1 and April 22. Over the same period of time last year, there was just one fire call. The year before that, there were two.

A Minnesota man is accused of sexually exploiting children abroad.

Researchers say if help doesn't arrive soon, the deep, dark boreal forests we know in northern Minnesota could become mostly grasslands within the next 50 years.

A Minnesota state senator was arrested early Monday morning on suspicion of burglarizing a Detroit Lakes home, according to police.

The 59th annual Flood Run motorcycle ride is this Saturday, and the Minnesota State Patrol is asking bikers and motorists alike to be extra careful while cruising beside the St. Croix River.

A partial building collapse in Superior, Wisconsin prompted evacuations Thursday, including at a nearby daycare.

Republican lawmakers have filed a new lawsuit alleging partial vetoes Gov. Tony Evers made to a bill designed to bolster students' reading performance were unconstitutional.

Nicolae Miu, the man convicted of reckless homicide and other crimes after stabbing five people on Wisconsin's Apple River in 2022, will be sentenced this summer.

The director of Donald Trump's 2020 presidential campaign in Wisconsin who pushed allegations of widespread fraud that were ultimately debunked has been hired to run the Republican Party of Wisconsin heading into the November election.

Eight students and one faculty member were arrested on Tuesday during anti-war protests at the Univeristy of Minnesota in Minneapolis.

It comes over a year after a shooting at a Nashville school killed three children and three adults.

Jurors in former President Donald Trump's trial in New York heard testimony from a former media executive about his efforts to bury negative stories about Trump before the 2016 presidential election.

Anoka County is one of the few counties that could decide who wins Minnesota in the 2024 presidential election.

Police arrested nine students during the first of two demonstrations Tuesday at the University of Minnesota.

The owner of a Twin Cities-based car dealership is accused of scamming Minnesotans out of thousands of dollars.

Saturday marks, for some, a holiday.

There's a state recovery fund for families who are out of money for a loss due to a contractor, but there's a gap in the law — a contractor with one specialty is exempt from paying into the fund.

The Minnesota Department of Health says state inspectors have seized and destroyed about $500,000 worth of illegal cannabis products from retailers.

The Minneapolis City Council on Thursday voted to delay implementation of a controversial ordinance establishing a minimum wage for rideshare drivers in the city.

Even though it's considered a lifetime ban, it isn't for everyone. In Dakota County, since 2019, 109 people there tried to have their gun rights restored. Of those, 72 succeeded.

Criminal charges have been filed against an 18-year-old man in connection to last summer's deadly mass shooting at the Minneapolis backyard music venue dubbed Nudieland.

The owner of a Twin Cities-based car dealership is accused of scamming Minnesotans out of thousands of dollars.

A Minnesota man is accused of sexually exploiting children abroad.

A Minnesota state senator now faces charges in connection to a burglary at a Detroit Lakes home earlier this week.

UnitedHealth said it paid the criminals behind attack that crippled hospitals and pharmacies to protect sensitive patient data.

Cancer cases are on the rise in younger adults, and early onset cancer is up in patients under 50, many of them without typical risk factors.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Health officials are warning consumers not to consume Infinite Herbs basil sold at some Trader Joe's and Dierberg's stores after 12 people were sickened.

Minnesota lawmakers are considering a bill to tweak the new paid family and medical leave program they passed last year.

The Vali-Hi Drive-In in Lake Elmo has been closed for almost two years now — but a filmmaker raised in Woodbury is keeping memories of the iconic theatre alive.

Eight years ago this week, music icon Prince died of an accidental painkiller overdose at his Paisley Park estate.

La Raza's mission is to bring music, news and community to more than 200,000 Latinos in the Twin Cities.

Mary J. Blige, Cher, Foreigner, A Tribe Called Quest, Kool & The Gang, Ozzy Osbourne, Dave Matthews Band and Peter Frampton have been named to the Rock & Roll Hall of Fame.

Eight years after Prince died from an accidental fentanyl overdose, thousands of his fans are flocking to the Twin Cities.