Northern Lights could be visible Friday as far south as Alabama, experts predict

Minnesotans will have a good shot at spotting the Northern Lights on Friday night, experts predict.

Watch CBS News

Minnesotans will have a good shot at spotting the Northern Lights on Friday night, experts predict.

The shooting occurred on the 3000 block of Irving Avenue North shortly after 7:30 p.m., according to the Minneapolis Police Department.

Rachel Hodges says her daughter, Da'Kyah, was shaking, having trouble walking and acting bizarrely Monday.

Since the end of April, Minnesota has managed to pick up at least another 2 inches of rain where it's really needed — in far southern, central and northwestern areas of the state.

Trump could significantly restrict abortion without ever imposing a federal ban, some experts say. Here's how he could do it.

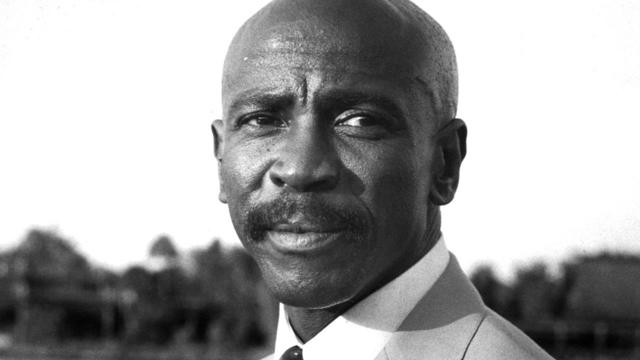

Journalist Charles Hallman is a staple at Target Center. But he found a passion for covering a neglected sports beat.

The new Minnesota state flag will officially be raised across the state on Saturday. So, what does the flag look like and what's the meaning behind its design?

Minnesota Timberwolves center Karl-Anthony Towns has won the NBA's top social justice award for his efforts in helping Minnesota restore voting rights to formerly incarcerated felons.

Minnesota's highest court has reversed a northern Minnesota man's conviction in a brutal 1986 sexual assault and slaying.

Last year, 22 air quality alerts were issued for Minnesota — 13 of them were orange, which means bad for people with pre-existing conditions. Nine were red — bad for everyone. Those 22 alerts spanned 52 days.

Minnesotans will have a good shot at spotting the northern lights on Friday night, experts predict.

Since the end of April, Minnesota has managed to pick up at least another 2 inches of rain where it's really needed — in far southern, central and northwestern areas of the state.

The Minnesota fishing opener is Saturday, and people are getting ready to head out onto the water.

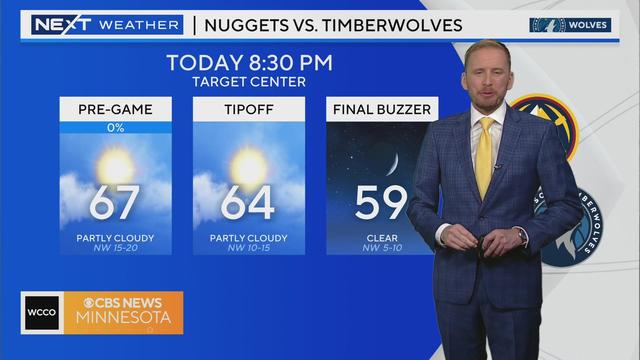

Meteorologist Adam Del Rosso says Friday will feature some spotty storms before a lovely Saturday and sweaty Mother’s Day.

If you want to stock up on Pride merchandise for next month, you may or may not be able to get it at Target.

Charles Hallman, who writes for the oldest continuously operated Black newspaper in Minnesota, is a staple at Target Center. But he found a passion for covering a neglected sports beat.

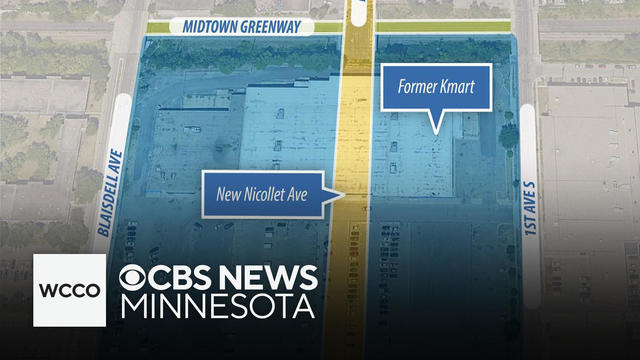

The Minneapolis City Council approved a plan on Thursday that will reconnect Nicollet Avenue 45 years after it was severed by a Kmart store.

Journalist Charles Hallman is a staple at Target Center. But he found a passion for covering a neglected sports beat.

After finishing their practice round on Monday night, the golfers were in their hotel rooms in Bartlesville, Oklahoma when they were told to go downstairs because a tornado was heading their way.

Manny Margot highlighted a five-run first inning for Minnesota with a three-run double off Seattle ace Logan Gilbert, and the Twins beat the Mariners 11-1 to win their fifth consecutive series.

Minnesota Timberwolves center Karl-Anthony Towns has won the NBA's top social justice award for his efforts in helping Minnesota restore voting rights to formerly incarcerated felons.

Tattoo artist JC Stroebel says he was ecstatic after the Wolves won Game 2 against Denver and took to social media.

A survey by the U.S. Fish and Wildlife Service shows 1.7 million anglers went fishing in Minnesota in 2022. Of those, 69% were residents and 31% were from out of state.

A summer sausage is apparently what's propelled the Twins to 12 straight victories. So, why are athletes superstitious? Good Question.

Cameras are appearing more frequently in courtrooms, but an age-old way to capture the moment is still finding its way into the spotlight.

Whether you're a new driver or new to the state, scheduling a driving test in Minnesota can be a bumpy road.

From drama involving Democratic Minnesota state Sen. Nicole Mitchell to now-former Republican Congressman George Santos, we've recently seen the flames of expulsion being fanned.

Andy Coulter died of cancer in March, leaving a hole in the Montevideo community he loved dearly.

Art and spoken word can help break down barriers and allow people to share openly when it comes to tough topics like gun violence.

On Monday, more than 500 people heard Fine Sternberg speak at Hopkins High School for a special assembly commemorating Yom Hashoah, the Jewish day of remembrance for the Holocaust.

Every Monday morning, in a warehouse just outside of town, about 25 volunteers gather to pack food, clothing, medical supplies and even fire protection equipment. Former pastor Lee Schuemann is helping organize.

Dr. Greg Ekbom founded LimbFit, a Christian nonprofit that designs and fits prosthetics and also works side-by-side in hospitals with Ukrainian trauma surgeons.

The nation's third-largest food bank is using a 24-hour fundraiser to fight food insecurity.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Fifteen-year-old Bennett Fisk loves baseball and has been playing youth league his whole life. Unfortunately, last season, he had to sit out because even the largest adult-size baseball helmet didn't fit his head and it was too unsafe to play without a helmet.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

Journalist Charles Hallman is a staple at Target Center. But he found a passion for covering a neglected sports beat.

The new Minnesota state flag will officially be raised across the state on Saturday. So, what does the flag look like and what's the meaning behind its design?

Last year, 22 air quality alerts were issued for Minnesota — 13 of them were orange, which means bad for people with pre-existing conditions. Nine were red — bad for everyone. Those 22 alerts spanned 52 days.

The shooting occurred on the 3000 block of Irving Avenue North shortly after 7:30 p.m., according to the Minneapolis Police Department.

The 17-year-old from Minneapolis is facing two counts of second-degree murder in the deaths of 16-year-olds Diriye Abdi Muhumed and Chardid Farah.

Last year, 22 air quality alerts were issued for Minnesota — 13 of them were orange, which means bad for people with pre-existing conditions. Nine were red — bad for everyone. Those 22 alerts spanned 52 days.

Minnesotans will have a good shot at spotting the northern lights on Friday night, experts predict.

Rural Minnesotans say they're getting hit hard by what they call a "chaotic" health care scene.

After finishing their practice round on Monday night, the golfers were in their hotel rooms in Bartlesville, Oklahoma when they were told to go downstairs because a tornado was heading their way.

Minnesota's highest court has reversed a northern Minnesota man's conviction in a brutal 1986 sexual assault and slaying.

Republicans who control the Wisconsin Legislature's audit committee have voted to launch a probe of diversity initiatives across state government.

A pair of wedding barns sued the state of Wisconsin on Tuesday seeking to block the enactment of a new law requiring them to get liquor licenses similar to other establishments that host events.

Milwaukee's election leader has been ousted by the mayor in a surprise move that comes just six months before Wisconsin's largest city will be in the spotlight in the presidential swing state.

Police in Wisconsin fatally shot a student who had pointed a pellet rifle in their direction outside a middle school, according to the state's Department of Justice.

Anglers will head to Wisconsin this weekend for the state's fishing opener, where they'll get a good idea of how the mild winter will also impact the fish bite during next week's opener in Minnesota.

Trump could significantly restrict abortion without ever imposing a federal ban, some experts say. Here's how he could do it.

The bill stalled earlier this week after senators from Virginia and Maryland objected to a provision that would allow an additional 10 flights a day to and from Ronald Reagan Washington National Airport.

Buying a gun for someone who is not legally allowed to have one — known as a straw purchase — would become a felony under a bill that got approval from the Minnesota Senate Thursday.

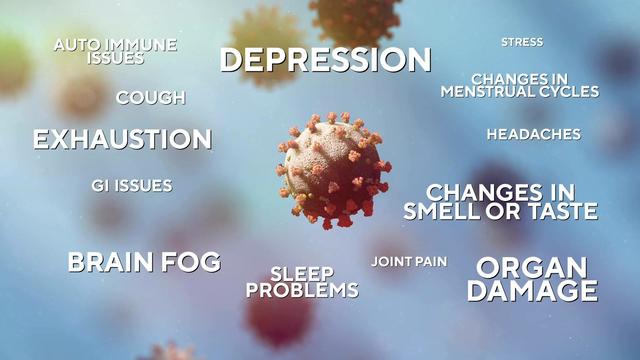

For most of us COVID-19 is thankfully in our rearview mirrors. But for some the symptoms still linger, having never lost its grip. In Talking Points, Esme Murphy spoke with Lisa Pettigrew and Galen Smith about their long covid experience.

For most of us COVID-19 is thankfully in our rearview mirrors. But for some the symptoms still linger, having never lost its grip. In Talking Points, Esme Murphy spoke Kate Murray with the Minnesota Department of Health and long covid sufferer Shane Hendricks.

Rural Minnesotans say they're getting hit hard by what they call a "chaotic" health care scene.

The red-hot Minnesota Timberwolves are back home on Friday to take on the Denver Nuggets in game three of the Western Conference semifinal series — and tickets aren't cheap.

Gov. Tim Walz on Tuesday signed a ticket transparency bill aimed at protecting music fans when they buy tickets for shows.

Owning and protecting a home or a car in Minnesota is getting more expensive.

The amendment, which was heard in a House committee Tuesday, includes a minimum wage pay rate of $1.27 per mile and 49 cents per minute. That committee advanced the bill in an 8-4 vote.

Minnesota made history by establishing the first Missing and Murdered Black Women and Girls Office in the country. Now we know who will lead the ground-breaking unit.

The shooting occurred on the 3000 block of Irving Avenue North shortly after 7:30 p.m., according to the Minneapolis Police Department.

The 17-year-old from Minneapolis is facing two counts of second-degree murder in the deaths of 16-year-olds Diriye Abdi Muhumed and Chardid Farah.

A Minneapolis teenager is accused of fleeing police in a stolen vehicle near the University of Minnesota campus Sunday, causing a crash involving two other vehicles.

Minnesota's highest court has reversed a northern Minnesota man's conviction in a brutal 1986 sexual assault and slaying.

Rural Minnesotans say they're getting hit hard by what they call a "chaotic" health care scene.

Students at North St. Paul High School were lifting each other up as part of Shoe Day — a program by NAMI Minnesota that encourages teens to imagine themselves in each others' shoes.

The fitness chain's $10 monthly membership is one of few things that had remained unchanged since 1998 — until now.

For most of us COVID-19 is thankfully in our rearview mirrors. But for some the symptoms still linger, having never lost its grip. In Talking Points, Esme Murphy spoke with experts who working to track and treat long COVID.

Panera is phasing out a highly caffeinated selection of lemonade beverages that's at the center of several lawsuits.

This will be the first baby for Hailey and Justin Beiber, who announced their pregnancy after more than five years of marriage.

Prince fans can add another stop to the list of must-see Twin Cities sites to celebrate the 40th anniversary of "Purple Rain."

UmaSofia Srivastava resigned as Miss Teen USA on Wednesday, just two days after Noelia Voigt stepped down as Miss USA.

International superstar Becky G is set to take the stage at the Minnesota State Fair Grandstand this summer.

Brian Fox, a fellow producer and engineer at Albini's Electrical Audio studio in Chicago, confirmed Albini passed away Tuesday night from a heart attack.