Minneapolis police chief says carjacking crackdown is working as auto theft numbers drop

Despite recent incidents, carjackings and auto thefts are actually down across Minneapolis.

Watch CBS News

Despite recent incidents, carjackings and auto thefts are actually down across Minneapolis.

The Hennepin County Attorney's office has entered into a contract with a Washington D.C.-based law firm amid an internal shakeup to prosecute Ryan Londregan, who shot and killed Ricky Cobb II on an interstate last summer.

This heated debate comes just one day after a pro-Palestinian encampment agreed to pack up and clear out after reaching an initial agreement with university administration.

Four people were injured on Friday afternoon when a tree branch fell during a funeral.

Twenty-four-year-old Madison Bergmann, of St. Paul, was charged with one count of first-degree child sexual assault with a child under age 13.

A teenage boy was rescued from a Twin Cities swamp Thursday with the help of a drone and several first responders, including a trusted school resource officer.

The man who officers shot in Woodbury during a standoff outside a Target store now faces assault charges.

A man who was involved in a shootout that killed a 14-year-old boy at a Woodbury graduation party in the summer of 2021 was sentenced Friday to 20 years in prison.

The Minnesota Twins have placed center fielder Byron Buxton on the 10-day injured list because of inflammation in his troublesome right knee, with guarded optimism his absence can be kept to the minimum.

Canadian wildfires in 2023 caused multiple days of smoke and poor air quality in Minnesota.

Moderate to severe drought persists across most of northern Minnesota, and 18% of the state is now in a moderate drought or worse, down from 47% at the start of the year.

Xcel's Sherco solar facility is the largest solar project in the state of Minnesota, and by the time it's done in 2026, it'll be the fifth-largest solar facility in the country.

Pro-Palestinian and pro-Israeli groups are still going head-to-head at the university.

Steady rain is falling to the north and will make it to the Twin Cities in the morning hours on Saturday.

He came from Southern Illinois University and made it to the NBA.

The agreement stipulates that the attorneys — former federal prosecutors — will make a blended $850 an hour, while paralegals will make $250 an hour.

Investigators say 61-year-old Donald Roche pointed a BB gun at officers outside a Target in Woodbury last month.

Anglers will head to Wisconsin this weekend for the state's fishing opener, where they'll get a good idea of how the mild winter will also impact the fish bite during next week's opener in Minnesota.

This inaugural season of the PWHL has been a long time coming.

The St Paul Academy boys' tennis team is hoping to hold onto the dynasty they've created, working to three-peat their single-A state championship title.

A bill to legalize sports betting in Minnesota is in serious trouble, running afoul of the partisan rancor over the arrest of a state senator on a felony burglary charge.

Natalie Spooner scored twice and Toronto clinched first place in the inaugural season of the Professional Women's Hockey League with a 4-1 win over Minnesota on Wednesday night.

Whether you're a new driver or new to the state, scheduling a driving test in Minnesota can be a bumpy road.

From drama involving Democratic Minnesota state Sen. Nicole Mitchell to now-former Republican Congressman George Santos, we've recently seen the flames of expulsion being fanned.

Releasing balloons is like slowly littering potentially miles from where the person let them go.

Minnesotans love to get outside no matter the season. Something about being in nature always seems to leave us feeling better. So why does it feel good to get outdoors? Good Question.

What do Lebron James, David Bowie and Bill Gates all have in common? They're left-handed. While they're a minority of the population, they're not alone. So why are we right- or left-handed? Good Question.

Dr. Greg Ekbom founded LimbFit, a Christian nonprofit that designs and fits prosthetics and also works side-by-side in hospitals with Ukrainian trauma surgeons.

The nation's third-largest food bank is using a 24-hour fundraiser to fight food insecurity.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Fifteen-year-old Bennett Fisk loves baseball and has been playing youth league his whole life. Unfortunately, last season, he had to sit out because even the largest adult-size baseball helmet didn't fit his head and it was too unsafe to play without a helmet.

For the first time in Minnesota cannabis usage on 420 is legal.

A new restaurant is hoping to serve the community for years to come.

Investigators have found at least 265 cats in just three Minnesota homes since late February.

Buzunesh Deba, who lives in the Bronx, became the default winner of the 2014 Boston Marathon in 2016 when the first-place winner was disqualified for doping, but she says she has not yet received her prize money.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

This heated debate comes just one day after a pro-Palestinian encampment agreed to pack up and clear out after reaching an initial agreement with university administration.

Despite recent incidents, carjackings and auto thefts are actually down across Minneapolis.

The man who officers shot in Woodbury during a standoff outside a Target store now faces assault charges.

A man who was involved in a shootout that killed a 14-year-old boy at a Woodbury graduation party in the summer of 2021 was sentenced Friday to 20 years in prison.

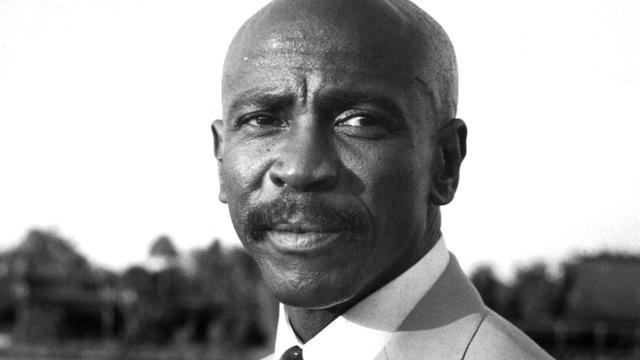

A Minnesota city is once again wrestling with the controversial past of one of its most famous residents.

At St. Cloud State, students and faculty were told in 2023 that the university faced tough decisions ahead, and proposed a series of cuts to faculty and programming. They included closing the School of Public Affairs, as well as dropping dozens of areas of study.

Authorities are searching for a man they say robbed a central Minnesota bank on Thursday.

The Morrison County Sheriff's Office says it received a report around 6:48 p.m. of an ATV accident on the Soo Line Trail, about a mile west of Highway 10 in Bellevue Township.

rom unpredictable weather to unpredictable farm prices, rural Minnesotans face challenges every day.

Canadian wildfires in 2023 caused multiple days of smoke and poor air quality in Minnesota.

Anglers will head to Wisconsin this weekend for the state's fishing opener, where they'll get a good idea of how the mild winter will also impact the fish bite during next week's opener in Minnesota.

Twenty-four-year-old Madison Bergmann, of St. Paul, was charged with one count of first-degree child sexual assault with a child under age 13.

Officials say that a school shooting threat was "neutralized" at a middle school west of Madison, Wisconsin, Wednesday morning, with no reported injuries to those inside the school.

Police are removing an encampment of pro-Palestinian protesters at the University of Wisconsin's Madison campus on Wednesday morning and have taken away several protesters.

Six middle school students and two adults were injured in a school bus crash near Hudson on Thursday morning.

South Dakota Gov. Kristi Noem claimed in a new book to have met with North Korean leader Kim Jong Un during her time in Congress.

Minnesota Lt. Governor Peggy Flanagan highlighted a way on Friday for more people to become police officers thanks to public safety funding passed last session at the Capitol.

Two measures that would strengthen gun laws in the state are now on their way to the Minnesota Senate.

A bill to legalize sports betting in Minnesota is in serious trouble, running afoul of the partisan rancor over the arrest of a state senator on a felony burglary charge.

Democratic Arizona Gov. Katie Hobbs has signed a bill to undo a long-dormant law that bans all abortions except those done to save a patient's life, but the ban is still in effect until the fall.

Are you looking for love this summer? Caribou Coffee is ready to play cupid.

John Lauritsen looks at how a Breezy Point barn went from housing buffalo and cattle to hosting customers and wedding parties.

For Minnesota sports fans, this is the wrong time for Bally Sports North to go black.

Americans are struggling to keep up with their credit card payments and personal bankruptcies are rising — and it's starting to worry economists.

The cost of buying a home continues to climb.

Despite recent incidents, carjackings and auto thefts are actually down across Minneapolis.

The man who officers shot in Woodbury during a standoff outside a Target store now faces assault charges.

A man who was involved in a shootout that killed a 14-year-old boy at a Woodbury graduation party in the summer of 2021 was sentenced Friday to 20 years in prison.

The Hennepin County Attorney's office has entered into a contract with a Washington D.C.-based law firm amid an internal shakeup to prosecute Ryan Londregan, who shot and killed Ricky Cobb II on an interstate last summer.

There were four different robberies of this variety with five victims within a period of less than half an hour in Bucktown Thursday morning. One of them was caught on video.

More new mothers and babies die in the United States than in any other high-income country, and Black women are three times more likely to die from pregnancy-related complications than White women.

You may have seen an anti-abortion ad that's taken over Minnesota airwaves recently. Esme Murphy reviewed 15 years of state abortion data to show us what's true, what needs context, and what is misleading.

Spring has sprung, and so have allergies. And if you've felt like your sniffles and sneezes are worse this year, you're not alone.

Mike Max is going to turn 60 years old this year and he's been thinking a lot about how to make the next ten years healthy years.

Minnesotans love to get outside no matter the season. Something about being in nature always seems to leave us feeling better. So why does it feel good to get outdoors? Good Question.

See who's nominated for the 77th annual Tony Awards. The Tonys will air live on CBS and Paramount+ on Sunday, June 16.

Paramount said long-time CEO Bob Bakish will leave the company, which is in discussions to explore a sale or merger.

Billie Eilish, the pop musician and two-time Oscar winner, will stop in St. Paul for two shows on her upcoming tour.

French screen actor Gerard Depardieu was reportedly detained for questioning and released Monday after two women accused him of sexual assault.

The vinyl sales alone were monumental, Billboard said, with "the largest sales week for an album on vinyl in the modern era."