2 people, 1 dog killed in central Minnesota house explosion

The cause of the blast is being investigated by the sheriff's office and the State Fire Marshal.

Watch CBS News

The cause of the blast is being investigated by the sheriff's office and the State Fire Marshal.

Irritated by no-calls and irate over missed calls, the Nuggets melted down in a 106-80 loss to the Minnesota Timberwolves in Game 2 of the Western Conference semifinals Monday night.

The amendment, which was heard in a House committee Tuesday, includes a minimum wage pay rate of $1.27 per mile and 49 cents per minute. That committee advanced the bill in an 8-4 vote.

One of the state's biggest universities plans to move ahead with major cuts to both faculty and programming.

June 6 will be the 80th anniversary of the D-Day invasion. Some Americans who took part in the liberation of Europe will be going back to Normandy for the last time.

Jamal Murray tossed a towel and a heat pack onto the court late in the second quarter of Denver's 108-80 loss to Minnesota.

Even though it's only been a few years, the family has big dreams to expand the restaurant. Dreams of offering treats and baked goods. But their biggest dream of all is to open an Uzbek community center.

"He would drop anything at any moment," one friend said. "And I think the legacy that he is leaving is one people should strive for he was a really good human — hard to come by these days."

A former Mayo Clinic resident accused of fatally poisoning his wife last year may have been identifying as a widower before she even died, a new warrant reveals.

Nothing brings in the foot traffic to Sunnyside Gardens in Minneapolis' Linden Hills neighborhood quite like a #Top10WxDay.

Canadian wildfires in 2023 caused multiple days of smoke and poor air quality in Minnesota.

Moderate to severe drought persists across most of northern Minnesota, and 18% of the state is now in a moderate drought or worse, down from 47% at the start of the year.

They are unbeaten and the favorites to win a national title this weekend. The Gopher men's gymnastics team was eliminated three years ago as a varsity sport, but they keep competing. In keeping with the adversity, they have another challenge: Finding a place to practice after this season.

WCCO meteorologist Chris Shaffer says showers and thunderstorms will persist this evening.

Owning and protecting a home or a car in Minnesota is getting more expensive. Over the last year, the cost to insure your car jumped by 22%. Home rates are up almost 5%. WCCO's Allen Henry explains what you need to know about through-the-roof rates.

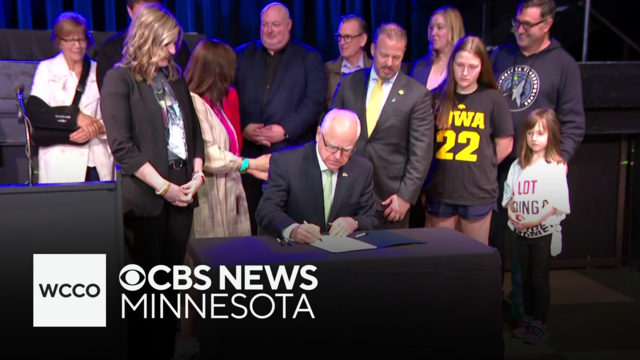

Ever felt sticker shock from buying a game or concert ticket? DFL Gov. Tim Walz signed a ticket transparency bill at First Avenue in Minneapolis on Tuesday. As Jonah Kaplan explains, the new law aims to crack down on hidden costs and misleading resellers.

The political fate of a Minnesota lawmaker and the rest of the legislative session now lies in her colleagues' hands. The ethics hearing is over allegations that DFL Sen. Nicole Mitchell burglarized her estranged stepmother's home last month.

Jamal Murray tossed a towel and a heat pack onto the court late in the second quarter of Denver's 108-80 loss to Minnesota.

Minnesota Timberwolves center Rudy Gobert won his fourth NBA Defensive Player of the Year award Tuesday night.

Irritated by no-calls and irate over missed calls, the Nuggets melted down in a 106-80 loss to the Minnesota Timberwolves in Game 2 of the Western Conference semifinals Monday night.

Another dominant performance by the Minnesota Timberwolves has the reigning but reeling NBA champion Denver Nuggets on the cusp of a stunning early exit from the playoffs.

Simeon Woods Richardson pitched six shutout innings of one-hit ball and the Minnesota Twins scored twice in the seventh to beat the Seattle Mariners 3-1 in the opener of their four-game series.

Cameras are appearing more frequently in courtrooms, but an age-old way to capture the moment is still finding its way into the spotlight.

Whether you're a new driver or new to the state, scheduling a driving test in Minnesota can be a bumpy road.

From drama involving Democratic Minnesota state Sen. Nicole Mitchell to now-former Republican Congressman George Santos, we've recently seen the flames of expulsion being fanned.

Releasing balloons is like slowly littering potentially miles from where the person let them go.

Minnesotans love to get outside no matter the season. Something about being in nature always seems to leave us feeling better. So why does it feel good to get outdoors? Good Question.

Art and spoken word can help break down barriers and allow people to share openly when it comes to tough topics like gun violence.

On Monday, more than 500 people heard Fine Sternberg speak at Hopkins High School for a special assembly commemorating Yom Hashoah, the Jewish day of remembrance for the Holocaust.

Every Monday morning, in a warehouse just outside of town, about 25 volunteers gather to pack food, clothing, medical supplies and even fire protection equipment. Former pastor Lee Schuemann is helping organize.

Dr. Greg Ekbom founded LimbFit, a Christian nonprofit that designs and fits prosthetics and also works side-by-side in hospitals with Ukrainian trauma surgeons.

The nation's third-largest food bank is using a 24-hour fundraiser to fight food insecurity.

An Eden Prairie family is keeping their son's legacy alive, one year after his sudden death.

Fifteen-year-old Bennett Fisk loves baseball and has been playing youth league his whole life. Unfortunately, last season, he had to sit out because even the largest adult-size baseball helmet didn't fit his head and it was too unsafe to play without a helmet.

For the first time in Minnesota cannabis usage on 420 is legal.

Many Minnesotans were treated to a stunning double rainbow on Thursday.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

Nicolae Miu, a 54-year-old man from Prior, Lake, Minnesota was found guilty of six criminal charges, including first-degree reckless homicide. Miu's trial lasted eight days in a Hudson, Wisconsin courtroom.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

This summer, metro area teens will get lessons in first response by land, lake and air.

Police say two men were shot in north Minneapolis on Monday evening, resulting in the arrest of two young women.

The amendment, which was heard in a House committee Tuesday, includes a minimum wage pay rate of $1.27 per mile and 49 cents per minute. That committee advanced the bill in an 8-4 vote.

Education Minnesota Lakeville said it came to agreement on a fair contract with Lakeville Area Public Schools Monday night after a 12-hour mediation session.

June 6 will be the 80th anniversary of the D-Day invasion. Some Americans who took part in the liberation of Europe will be going back to Normandy for the last time.

A former Mayo Clinic resident accused of fatally poisoning his wife last year may have been identifying as a widower before she even died, a new warrant reveals.

The amendment, which was heard in a House committee Tuesday, includes a minimum wage pay rate of $1.27 per mile and 49 cents per minute. That committee advanced the bill in an 8-4 vote.

Three men accused in a triple homicide at a Coon Rapids home now face first-degree murder charges.

Two people were killed in a home explosion in central Minnesota Tuesday morning, authorities said.

One of the state's biggest universities plans to move ahead with major cuts to both faculty and programming.

Milwaukee's election leader has been ousted by the mayor in a surprise move that comes just six months before Wisconsin's largest city will be in the spotlight in the presidential swing state.

Police in Wisconsin fatally shot a student who had pointed a pellet rifle in their direction outside a middle school, according to the state's Department of Justice.

Anglers will head to Wisconsin this weekend for the state's fishing opener, where they'll get a good idea of how the mild winter will also impact the fish bite during next week's opener in Minnesota.

Twenty-four-year-old Madison Bergmann, of St. Paul, was charged with one count of first-degree child sexual assault with a child under age 13.

Officials say that a school shooting threat was "neutralized" at a middle school west of Madison, Wisconsin, Wednesday morning, with no reported injuries to those inside the school.

Gov. Tim Walz on Tuesday signed a ticket transparency bill aimed at protecting music fans when they buy tickets for shows.

The start date for former President Trump's classified documents trial was originally scheduled for May 20.

The amendment, which was heard in a House committee Tuesday, includes a minimum wage pay rate of $1.27 per mile and 49 cents per minute. That committee advanced the bill in an 8-4 vote.

Group of Democrats from states including Minnesota, Nevada and Pennsylvania urges Biden "to use all tools at your disposal" to address border security issues.

Milwaukee's election leader has been ousted by the mayor in a surprise move that comes just six months before Wisconsin's largest city will be in the spotlight in the presidential swing state.

Gov. Tim Walz on Tuesday signed a ticket transparency bill aimed at protecting music fans when they buy tickets for shows.

Owning and protecting a home or a car in Minnesota is getting more expensive.

The amendment, which was heard in a House committee Tuesday, includes a minimum wage pay rate of $1.27 per mile and 49 cents per minute. That committee advanced the bill in an 8-4 vote.

"I don't see any ending for Uber and Lyft other than that they're going to say, 'We're leaving,' and scaring folks from Minnesota," said Eid Ali, the president and founder of the Minnesota Uber and Lyft Drivers Association.

Minnesota lawmakers announced an agreement that will set a statewide minimum wage for rideshare drivers, but Uber and Lyft have quickly come out against the compromise.

A former Mayo Clinic resident accused of fatally poisoning his wife last year may have been identifying as a widower before she even died, a new warrant reveals.

Police say two men were shot in north Minneapolis on Monday evening, resulting in the arrest of two young women.

Three men accused in a triple homicide at a Coon Rapids home now face first-degree murder charges.

It happened just before midnight outside the White Dragon Hall near White Bear Avenue and Idaho Avenue in St. Paul.

Jennifer Stately, 35, is facing multiple charges including murder, arson and child neglect for the death of two young children and the treatment of a 3-year-old boy.

Panera is phasing out a highly caffeinated selection of lemonade beverages that's at the center of several lawsuits.

The Minnesota Nurses Association plans to speak out Monday afternoon against proposed cuts to services at North Memorial hospitals and its clinics.

In an emerging world of artificial intelligence, we've got access to mental health tools with the touch of our fingertips.

Seven-year-old Emmett Cordes was born with a rare blood disorder, but through his love of science and storytelling, he's helping other kids like him understand how medicine works in their bodies.

More than 1,000 people were on the move Saturday all for the same goal: finding a cure for Parkinson's Disease.

Gov. Tim Walz on Tuesday signed a ticket transparency bill aimed at protecting music fans when they buy tickets for shows.

From cabin scapes to classic cars, artist and Minnehaha Academy teacher Nathan Stromburg crystallizes cherished memories into collages for clients. But this ask felt like it came from a galaxy far, far away.

The stars came out for the the 2024 Met Gala in New York City. See some of the most eye-catching outfits of the night.

'Bob Hearts Abishola', the acclaimed comedy, is signing off after its fifth season on CBS.

Tom Brady took his share of barbs from comedians, former teammates and his longtime coach during a made-for-streaming comedy live event on Netflix -- but one joke seemed to anger him.